How To Calculate Time Value Of Money With Financial Calculator

Time Value of Coin

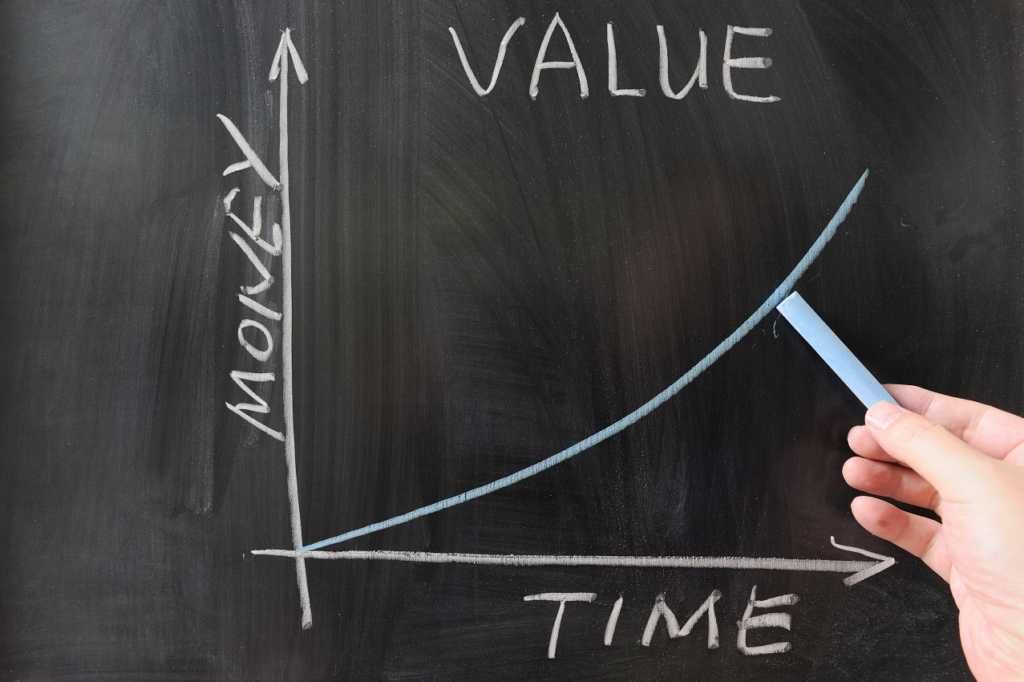

Money in the present is worth more than the same sum of money to be received in the hereafter

What is the Time Value of Money?

The fourth dimension value of money is a bones financial concept that holds that money in the present is worth more than the same sum of money to exist received in the future. This is true because money that you have correct now can be invested and earn a return, thus creating a larger corporeality of money in the future. (Also, with future money, at that place is the additional chance that the money may never really be received, for one reason or another). The time value of money is sometimes referred to as the internet nowadays value (NPV) of coin.

How the Time Value of Money Works

A simple example can be used to prove the time value of money. Presume that someone offers to pay you i of two ways for some work you are doing for them: They will either pay you lot $one,000 now or $ane,100 i year from now.

Which pay option should yous take? It depends on what kind of investment return you can earn on the coin at the present fourth dimension. Since $1,100 is 110% of $1,000, then if you lot believe you can make more than a 10% return on the money by investing information technology over the adjacent twelvemonth, y'all should opt to have the $1,000 at present.

On the other manus, if you don't think you lot could earn more than 9% in the adjacent yr past investing the money, then you should have the future payment of $1,100 – every bit long every bit yous trust the person to pay you then.

Time Value and Purchasing Power

The time value of coin is besides related to the concepts of inflation and purchasing power. Both factors need to be taken into consideration forth with any rate of return may be realized by investing the money.

Why is this important? Because inflation constantly erodes the value, and therefore the purchasing power, of money. It is all-time exemplified by the prices of bolt such as gas or food. If, for example, y'all were given a document for $100 of costless gasoline in 1990, you could take bought a lot more gallons of gas than you could have if you were given $100 of free gas a decade later.

Inflation and purchasing ability must be factored in when you invest money because to calculate your real return on an investment, you must decrease the rate of inflation from any percentage return you lot earn on your money.

If the rate of inflation is really higher than the rate of your investment return, so even though your investment shows a nominal positive return, y'all are actually losing money in terms of purchasing ability. For example, if yous earn 10% on investments, but the rate of inflation is xv%, you're actually losing 5% in purchasing ability each twelvemonth (x% – 15% = -5%).

Fourth dimension Value of Money Formula

The time value of money is an important concept not just for individuals, but also for making concern decisions. Companies consider the time value of money in making decisions about investing in new product development, acquiring new business organisation equipment or facilities, and establishing credit terms for the sale of their products or services.

A specific formula tin be used for calculating the future value of coin so that it tin can be compared to the present value:

Where:

FV = the future value of money

PV = the present value

i = the involvement charge per unit or other return that can be earned on the money

t = the number of years to have into consideration

north = the number of compounding periods of interest per yr

Using the formula higher up, let's look at an instance where you have $5,000 and can expect to earn 5% interest on that sum each year for the side by side 2 years. Assuming the interest is only compounded annually, the futurity value of your $5,000 today can exist calculated equally follows:

FV = $v,000 x (1 + (5% / i) ^ (1 x two) = $5,512.fifty

Present Value of Future Money Formula

The formula can also be used to calculate the nowadays value of money to be received in the futurity. Y'all simply separate the future value rather than multiplying the present value. This can be helpful in considering two varying present and future amounts.

In our original instance, we considered the options of someone paying your $ane,000 today versus $ane,100 a year from now. If y'all could earn 5% on investing the money at present, and wanted to know what present value would equal the future value of $1,100 – or how much money you would need in hand now in guild to take $i,100 a yr from now – the formula would be as follows:

PV = $1,100 / (1 + (five% / 1) ^ (1 x 1) = $1,047

The calculation higher up shows yous that, with an available return of five% annually, you would need to receive $one,047 in the present to equal the future value of $ane,100 to be received a yr from now.

To make things easy for y'all, there are a number of online calculators to figure the hereafter value or present value of money.

Internet Nowadays Value Example

Beneath is an illustration of what the Net Present Value of a serial of cash flows looks like. As you tin can meet, the Hereafter Value of greenbacks flows are listed across the top of the diagram and the Present Value of cash flows are shown in blue confined along the lesser of the diagram.

This example is taken from CFI's Free Introduction to Corporate Finance Form, which covers the topic in more item.

Additional Resource

We hope you've enjoyed CFI's explanation of the Time Value of Money. To learn more than nigh money and investing, cheque out the following resource:

- Adapted Present Value

- Forecasting Methods

- NPV Formula

- Valuation Methods

Source: https://corporatefinanceinstitute.com/resources/knowledge/valuation/time-value-of-money/

Posted by: staleywallst.blogspot.com

0 Response to "How To Calculate Time Value Of Money With Financial Calculator"

Post a Comment